If you’re researching financial institutions, then you likely would have come across Michigan First Credit Union. Founded during an era when service was the primary business for serving members, Michigan First Credit Union provides a wide variety of financial products and services appropriately tailored to cater to every individual need across the state. But what would make you think about joining Michigan First Credit Union over your typical bank? This article will explore seven strong reasons to be a member, with some of the unique benefits and opportunities that set Michigan First Credit Union apart.

Table of Contents

1. Competitive Financial Products and Services

Amongst some of the most important reasons to join a credit union is the vast array of financial products and services that Michigan First Credit Union offers. From savings accounts to loans, Michigan First Credit Union offers everything you need to manage your finances effectively.

- Savings and Checking Accounts: Michigan First Credit Union offers accounts without minimum balance that are all accessible to everyone. But what would be the lowest amount Michigan First requires? Unlike most traditional banks, Michigan First Credit Union often does not require a minimum balance for the primary accounts so that people even with modest financial means can avail itself of its service.

- These are loans and credit cards, whether you’re looking for a mortgage or just need to buy or finance an auto loan or apply for a credit card. Michigan First Credit Union gives competitive rates on loans and credit cards with flexible terms carefully designed to meet the needs of its members, a personalized approach ensuring you receive financial products that align with your goals.

- Money Now: Sometimes, you just need some cash. What is Money Now at Michigan First? Use it to get an advance on your direct deposits during that really tight time of month to help manage your cash flow.

2. Better Savings and Credit Union Account Dividends

Credit unions generally have lower fees and better interest rates than traditional banks, but Michigan First Credit Union makes no exception. As a not-for-profit institution, Michigan First Credit Union distributes its profits through reduced fees, increased savings, and reduced loan rates among its members.

- The comparative advantage: Is it better to bank at a bank or at a credit union such as Michigan First? A bank might look so appealing with some bit of security, but overall, most credit unions such as Michigan First usually offer more competitive financial terms and conditions because they are always owned by the members and not for the profit of those operating them. Savings and benefits produce tangible benefits to its members.

- No hidden fees: Most of the banks will make so much money on ‘hidden fees.” Michigan First Credit Union doesn’t believe in hiding fees, so it always keeps letting its members know exactly what they are paying for.

3. Community Oriented Banking

Michigan First Credit Union is really passionate about the communities it serves. As a member, you become part of an institution that works effectively to invest in local initiatives, educational programs, and charitable activities.

- Community Investment: It is more than just a financial institution; Michigan First Credit Union is a community partner. It supports local schools, sponsors community events, and makes provisions for financial literacy programs with a firm commitment toward the region’s well-being.

- Personalised Service: The credit union’s focus on the community is also reflected in customer service. Michigan First Credit Union offers personalized and attentive services to the members, reminding them that they are dealing with a person and not a number.

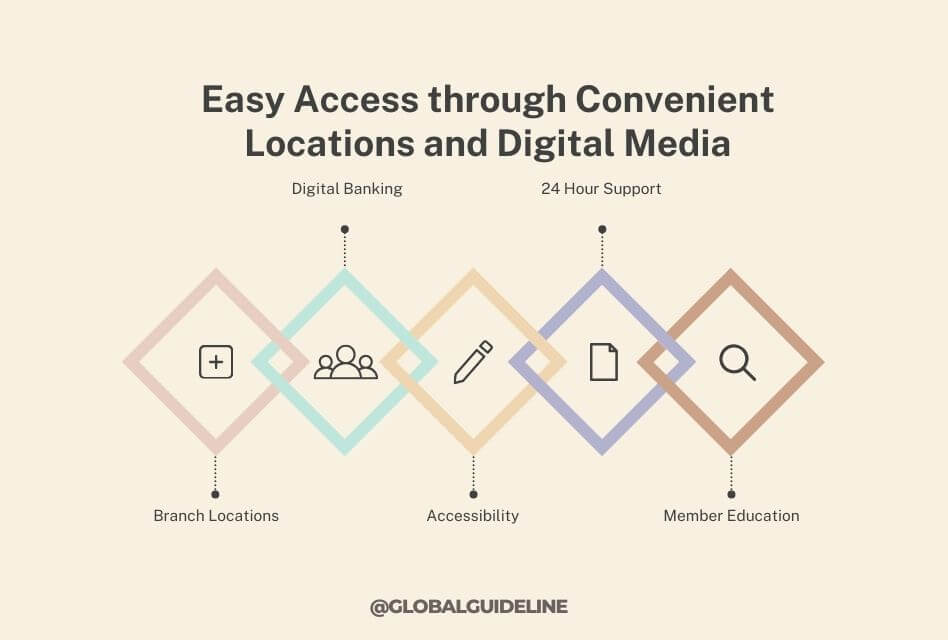

4. Easy Access through Convenient Locations and Digital Media

Michigan First Credit Union perfectly strikes a chord between a comfortable physical and digital convenience so that banking becomes easy and accessible for everyone.

- Branch Locations: First Credit Union now boasts branches all across the state of Michigan-from their flagship at 27000 Evergreen Road Lathrup Village and more in Grand Rapids and Detroit, MI-so you’re never too far from some great in-person service. And since there are now many Kroger grocery stores that have a First Michigan Credit Union location within them, members can take advantage of services without ever leaving the store.

- Digital Banking: Use your mobile phone to check account balance, transfer funds, or pay your bills-from any place with the Michigan First Credit Union app. You can use it to do all things online, as it is easy and secure.

- Accessibility: If you’re ever curious about what the routing number for Michigan First Credit Union is, simply visit their website or call a customer care representative to inquire.

5. Robust Member Support and Customer Services

Customer service is at the very heart of what Michigan First Credit Union does. Whether opening a new account or seeking to apply for a loan, the customer services are at your beck and call.

- 24 Hour Support: The Michigan First Credit Union phone number connects you with a knowledgeable service representative staff who can help with everything from account inquiries to directions toward financial guidance. They have round-the-clock customer service, so you never have to be unsure about getting the assistance you need.

- Member Education: Michigan First Credit Union takes customer service to the next level by adding financial education. Learn all about budgeting, saving or investing-every tool and workshop helps make good decisions in your finances.

6. Career Opportunities and Employee Benefits

Michigan First Credit Union is not only an excellent place to bank but also a fantastic place to work. It offers opportunities in its branches and corporate offices in the wide variety of careers.

- Employment Opportunities: Jobs at Michigan First Credit Union include customer service, financial advisement, and management. Working with Michigan First Credit Union is a privilege by being part of a team that upholds integrity, innovation, and community service.

- Employee Benefits: A credit union with competitive salaries, comprehensive health benefits, and opportunities for professional growth. Employees are encouraged to grow within the organization, so it is a rewarding place to build a career.

7. Financial Security and Trust

Security and trust matter most when you are deciding on which financial institution is right for you. Michigan First Credit Union is an established, financially sound institution you can depend upon.

- Is Michigan First Credit Union FDIC Insured? Credit unions are not technically FDIC insured, but a credit union is insured by the National Credit Union Administration (NCUA), which does the same thing, meaning that your deposits at Michigan First Credit Union would be safe up to $250,000 per depositor.

- Trusted Institution For nearly 175 years, Michigan First Credit Union is the trusted and financially stable institution of choice, so members have confidence that their money is being placed with someone who can be trusted.

Additional Services and Features

In addition to these main attractions for joining, Michigan First Credit Union offers several secondary features appealing to even the most careful observer.

- Loans and Mortgages: If you want to purchase a house or perhaps the financing of any vehicle, Michigan First Credit Union loans offer competitive rates with flexible terms tailored to meet your specific needs.

- Mobile Deposits and Zelle: Does Michigan First Credit Union Have Zelle? Yes, Michigan First Credit Union allows integration with Zelle. In the mobile app, members can quickly and safely send and receive money.

- Counters for change and ChexSystems: But, does Michigan First Credit Union offer change counters? Well, yes; it does. At least, you can find them at some branches. And, if you have or had a bad banking history, you might want to ask, does Michigan First Credit Union use ChexSystems? Indeed, while most credit unions check ChexSystems, Michigan First has much more relaxed standards than most banks for opening an account.

FAQs

Q: Does Michigan First have any minimum balance requirements?

A: To open a basic account, Michigan First Credit Union doesn’t require its customers to meet most minimum balances of most major banks, keeping all financial channels open to anyone.

Q: Which is the best credit union in Michigan?

A: Based on reputation, customer service, competitive rates, and participation within the community, Michigan First Credit Union is one of the best credit unions Michigan has to offer.

Q: What is Money Now at Michigan First?

A: Money Now is another advance cash facility-a member may access advances on direct deposits to attempt to stretch cash during tough times.

Q: Is Michigan First Credit Union FDIC insured?

A: While not technically FDIC-insured, Michigan First Credit Union is insured by the NCUA, which provides the same level of deposit protection-as an FDIC insurance.

Q: Does Michigan First Credit Union offer Zelle?

A: Yes, through mobile banking services provided by Michigan First Credit Union, you can use Zelle, hence making it easy and safe to send money to anyone.

Conclusion

Being a member of the Michigan First Credit Union means you are opening up more than just a new bank account; rather, you’re part of a community-driven place which first prioritizes your health. This makes Michigan First Credit Union stand out as the first choice any individual would want for effective financial management, given the competitive products good support offered to the customers and commitment to the local community. You want personal banking, loans, or an excellent partner in finance, and that is where Michigan First Credit Union is positioned to help take your finance to a higher level. Take the step today and discover why so many of you trust Michigan First Credit Union.

Related Posts:

How Can 5 Entry Level Computer Science Jobs Help You Launch Your Career?